Get Schedule F Creditors Holding Unsecured Nonpriority Claims Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule F Creditors Holding Unsecured Nonpriority Claims Form online

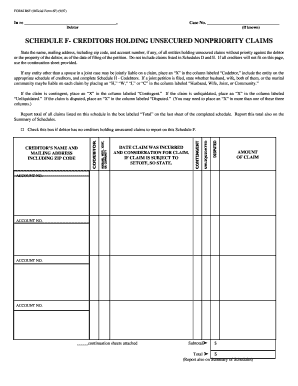

Filling out the Schedule F Creditors Holding Unsecured Nonpriority Claims Form is an essential step in managing your financial obligations during bankruptcy proceedings. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form effectively.

- Click the ‘Get Form’ button to access the Schedule F form and open it in your preferred editor.

- Begin by entering the debtor's name and case number at the top of the form. Ensure this information reflects the details provided in your bankruptcy petition.

- In the section for creditors, list the name and mailing address, including zip code, of each entity that holds an unsecured claim against the debtor. If you have an account number for any of these claims, include it as well.

- Indicate the date the claim was incurred and the consideration for the claim if applicable. If the claim is subject to setoff, please note that as well.

- For claims that may have joint liability, place an ‘X’ in the column labeled ‘Codebtor’ and ensure those entities are included in the appropriate schedule.

- If a joint petition has been filed, specify the default liabilities using ‘H’ for Husband, ‘W’ for Wife, ‘J’ for Joint, or ‘C’ for Community in the designated column.

- For claims that are contingent, unliquidated, or disputed, mark the corresponding columns with an ‘X’ as necessary. You may need to mark more than one of these columns for a single claim.

- At the end of the form, report the total amount of all claims listed in the box labeled ‘Total’ and ensure this total is documented on the Summary of Schedules.

- If you have no creditors to report, check the box marked accordingly at the bottom of the form.

- After completing the form, make sure to save your changes. You may choose to download, print, or share the form as necessary.

Complete your documents online to ensure a smooth financial process.

Related links form

A common example of a non-priority unsecured claim is credit card debt. In this case, the creditor does not hold any collateral to secure the debt, meaning they rely solely on your promise to repay. If you file for bankruptcy, the Schedule F Creditors Holding Unsecured Nonpriority Claims Form helps outline these debts. Understanding these claims clearly can help you better navigate your financial obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.