Loading

Get Ifta Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IFTA GA online

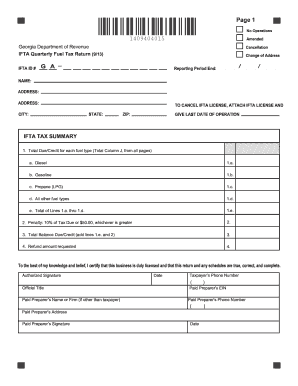

Filing the IFTA Quarterly Fuel Tax Return, known as the IFTA GA, is an essential requirement for those operating under the International Fuel Tax Agreement. This guide provides clear, step-by-step instructions to help you complete the form online efficiently and accurately.

Follow the steps to fill out the IFTA GA online.

- Press the ‘Get Form’ button to access the IFTA GA and open it in your editor.

- Begin by entering your IFTA ID number along with the name and address of the registered licensee. Ensure that you input the reporting period end date correctly as it reflects the period covered by your return.

- If you did not operate in any jurisdiction during the quarter, check the ‘No Operations’ box. If you are amending a previously filed return, select the ‘Amended’ box. For those looking to cancel their license, check the ‘Cancellation’ box and ensure to attach your unused decals along with the completed report.

- Complete the ‘IFTA Tax Summary’ section by reporting the total due or credit earned for each fuel type. Include potential penalties and calculate the total balance due or credit, as well as any refund amount you are requesting.

- Fill out the ‘IFTA Tax Return Schedule’ by entering the total miles traveled in IFTA and non-IFTA jurisdictions. Be sure to report total gallons of fuel used and calculate the average miles per gallon.

- In each column, ensure you accurately enter the respective data for all IFTA jurisdictions. This includes tax rates, taxable gallons, and total due/credit amounts.

- Review all entries for accuracy before finalizing your return. Once satisfied, you can save your changes, download the document, or print it for submission.

- Submit the completed return along with any payment required to the address specified for the Georgia Department of Revenue.

Prepare to complete your documents online today!

Getting IFTA in Georgia involves applying for an IFTA license and obtaining your IFTA decals. You can accomplish this through the Georgia Department of Revenue's website or in person. Make sure you collect all necessary documentation, as accurate records are essential for compliance. For a smoother experience, consider utilizing USLegalForms, where you can find valuable resources tailored for IFTA in GA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.