Loading

Get Irs Form 2159

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 2159 online

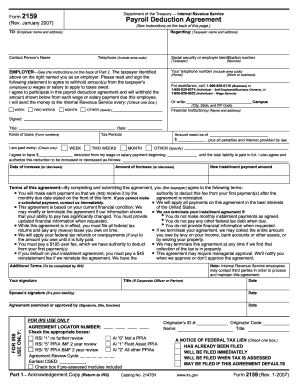

Filling out the Irs Form 2159, also known as the payroll deduction agreement, can be a straightforward process when approached step by step. This guide will provide clear instructions to assist you in completing the form online.

Follow the steps to successfully complete your Irs Form 2159 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the employer's name and address where indicated. This ensures proper identification of the employer involved in the agreement.

- In the section for taxpayer information, list the taxpayer's name and their current address to establish their identity and contact details.

- Provide the contact person's name from the employer side, including a telephone number with the area code for any necessary follow-up.

- Include the social security number or employer identification number of the taxpayer in the specified field to confirm their identification.

- Indicate the payment agreement by checking the box for the payment frequency, whether it be weekly, biweekly, or monthly.

- Specify the amount to be deducted from each payment. This must be the amount agreed upon with the Irs during any prior discussions.

- Complete the section concerning the dates for the start of deductions, including any increases or decreases in the deduction amount if applicable.

- Carefully read the terms of the agreement as outlined in the form, confirming that all obligations and responsibilities are understood.

- After completing all sections, sign and date the form, ensuring that all required parties sign if applicable, including a spouse for joint liabilities.

- Once the form is filled out, save your changes. You may then choose to download, print, or share the form as needed.

Complete your necessary documents online today for a hassle-free experience.

Form 8453 is used to authenticate electronically submitted tax returns. It serves as a declaration that the information provided on the electronic return is accurate. This form works alongside IRS Form 2159, ensuring that any payroll deductions or agreements are accurately reported.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.