Loading

Get Non Erisa Covered 403b Plan Franklin Templeton Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Erisa Covered 403b Plan Franklin Templeton Form online

Filling out the Non Erisa Covered 403b Plan Franklin Templeton Form online is a straightforward process. This guide provides a step-by-step overview to assist you in completing the form efficiently and accurately.

Follow the steps to complete your form online.

- Click 'Get Form' button to obtain the form and open it in your browser's editor.

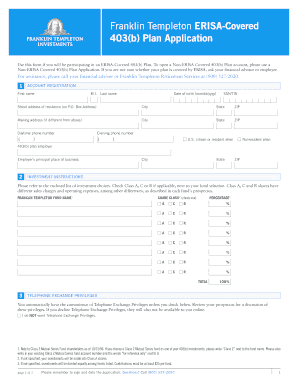

- Provide your personal information in the 'Account Registration' section. Fill in your first name, middle initial, last name, date of birth (mm/dd/yyyy), and social security number or taxpayer identification number.

- Enter your street address, city, state, and ZIP code. If your mailing address differs from your home address, include that information as well.

- Include your daytime and evening phone numbers.

- Indicate your citizenship status by checking either 'U.S. citizen or resident alien' or 'Nonresident alien.'

- Specify your 403(b) plan employer, including the employer’s principal place of business, city, state, and ZIP code.

- In the 'Investment Instructions' section, refer to the investment choices list and select your fund. Check the appropriate Class (A, C, or R) next to your fund selection and indicate the investment percentage for each fund.

- If you want to decline Telephone Exchange Privileges, please check the box provided in the 'Telephone Exchange Privileges' section.

- Complete the 'Financial Advisor Information' section if applicable. Your financial advisor will provide their name, firm, addresses, and contact details.

- Designate your beneficiaries in the 'Beneficiary Designation' section. You must indicate whether each is a primary or contingent beneficiary and provide their details.

- Sign and date the application to certify that the information provided is accurate and complete.

- After ensuring all information is filled out correctly, save your changes, download, print, or share the completed form as necessary.

Start filling out your Non Erisa Covered 403b Plan Franklin Templeton Form online today.

To set up a 403 B retirement plan, begin by selecting a plan provider that meets your needs. You'll need to review the different investment options available, including those from Franklin Templeton. Next, gather the necessary documentation to complete the Non Erisa Covered 403b Plan Franklin Templeton Form. Finally, establish contributions and enrollment details for your plan participants.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.