Loading

Get Ing Withdrawal Request 401 Corporate Erisa Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ing Withdrawal Request 401 Corporate Erisa Form online

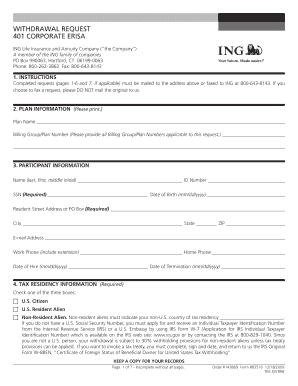

This guide provides step-by-step instructions on filling out the Ing Withdrawal Request 401 Corporate Erisa Form online. Follow these detailed steps to ensure your withdrawal request is completed accurately.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your plan information in the designated fields. This includes the plan name and the billing group or plan number. Ensure all details are filled in clearly and accurately.

- Fill out the participant information section with your full name, ID number, Social Security Number (SSN), date of birth, and contact details. Remember to include your residential address and email address.

- Complete the tax residency information by selecting one of the options: U.S. citizen, U.S. resident alien, or non-resident alien. If you are a non-resident alien, provide details of your tax residency country.

- In the reason for withdrawal section, check the appropriate box indicating whether it is a separation from service or an in-service withdrawal, and provide any relevant details.

- Specify the type of withdrawal you are requesting. This could be a cash distribution, direct rollover, or transfer. Make sure to choose what corresponds to your situation.

- Indicate the withdrawal amount. If applicable, your employer or third-party administrator should complete this section as it may require specific calculations.

- Fill out the tax withholding section, indicating your preferences regarding federal and state tax withholdings. Consult a tax advisor if unsure about your choices.

- Provide any special instructions necessary for your withdrawal. This could include unique circumstances that need to be noted in your request.

- Finally, review the payment and mailing information, ensuring you select the appropriate options for how you wish to receive your funds.

- If you wish to authorize an electronic fund transfer (EFT) for faster access to your funds, complete the EFT section with your bank information.

- After filling out all necessary fields, save your changes. You can then download, print, or share the completed form as needed.

Complete your withdrawal request online today to take the next steps towards your financial future.

If you did not receive a 1099-R for your 401k, it could be due to various reasons, such as the timing of your withdrawal or administrative oversight. It is advisable to check with your plan administrator for clarification. Reviewing your Ing Withdrawal Request 401 Corporate Erisa Form might also help in understanding any discrepancies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.