Loading

Get Horry County Form Pr 26 Tax Year 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Horry County Form Pr 26 Tax Year 2019 online

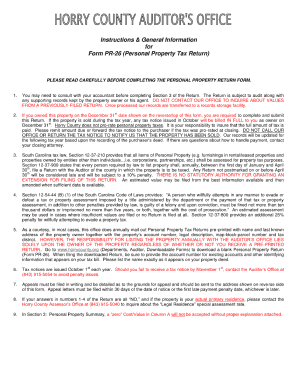

Filling out the Horry County Form Pr 26 for Tax Year 2019 online can seem daunting, but this guide will walk you through each step. By following these clear instructions, you can ensure that your form is completed accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully review the form sections. Begin with the personal information section, where you will input your name, address, and contact information. Make sure to provide accurate details as they relate to the tax year.

- Next, locate the section related to property details. Here, you will need to provide information about the property for which you are filing the form. Include specifics such as the parcel number and property type.

- In the valuation section, enter the assessed value of your property as determined by the county. This may require you to reference previous assessments or property tax notices.

- Review the exemptions section. If applicable, select any exemptions for which you qualify. You may need to provide documentation or additional information based on the exemptions chosen.

- Complete the affirmation statement by indicating your acknowledgment of the information provided. This section often requires your signature and date, confirming that the details entered are truthful.

- After completing all necessary fields, ensure all entries are accurate and review for any errors. You can then save changes, download, print, or share the completed form as needed.

Start filling out your Horry County Form Pr 26 online today!

Yes, South Carolina imposes an annual property tax on vehicles, which includes cars, trucks, and motorcycles. This tax is based on the fair market value of the vehicle and is due each year. To make sure you have all the necessary information, refer to the Horry County Form Pr 26 Tax Year 2019, as it will help clarify your vehicle tax responsibilities and payment options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.