Get Goldman Sachs Ira Transfer Out Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Goldman Sachs Ira Transfer Out Form online

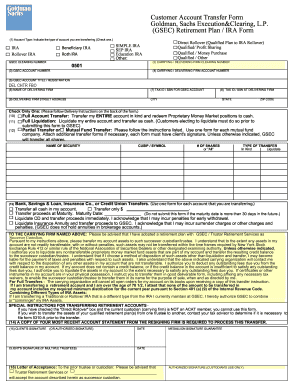

Filling out the Goldman Sachs Ira Transfer Out Form is an essential step in transferring your retirement assets smoothly and efficiently. This guide provides a clear, step-by-step approach to ensure that you complete the form correctly and avoid any potential delays.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to obtain the form and open it for completion in an appropriate editor.

- In the account type section, indicate the type of account you are transferring by checking one of the options provided. Ensure that you select the appropriate option that corresponds to your circumstances.

- Enter the delivering firm's clearing number. This number identifies the firm that currently holds your account and can be obtained from Goldman Sachs if you do not have it.

- Provide your GSEC account number, which is the account that will be receiving your assets from the delivering firm.

- Fill out the delivering firm's account number, which corresponds to the account your assets are being transferred from. Ensure you are using the correct number for the specific account.

- Specify the GSEC account title or registration. This should match the registration on your GSEC account.

- Input the name of the delivering firm, which is the brokerage where your assets are currently held.

- Provide your Tax ID or Social Security Number for your GSEC account, ensuring it is correct to avoid processing delays.

- Fill in the Tax ID or Social Security Number associated with the delivering firm account.

- List the delivering firm's street address, including the city, state, and ZIP code. This information is necessary for accurate correspondence.

- Choose the type of transfer you prefer: full account transfer, full liquidation, or partial transfer/mutual fund transfer. Select only one option and follow any specific instructions related to that choice.

- If applicable, provide details for the type of assets being transferred, including their names, symbols, and number of shares, along with indicating whether the transfer should be made in kind or liquidated.

- If any transfers relate to a bank, savings and loan, or credit union, fill out the appropriate boxes for how these assets will be transferred.

- Attach a copy of your most recent account statement from the delivering firm, ensuring it is dated within the last three months to facilitate the transfer process.

- Sign the form in the client’s signature section. Ensure the name matches the account title with the delivering firm and the statement provided.

- Complete the letter of acceptance if you are transferring to a GSEC retirement account. This section will be filled out by GSEC upon submission.

- After reviewing the filled form for accuracy, save changes, and proceed to download, print, or share the completed form as necessary.

Complete your documents online today to ensure a smooth transfer process.

Transferring your IRA to a self-directed IRA involves completing the Goldman Sachs IRA Transfer Out Form and specifying the new self-directed account details. You will need to provide personal identification and possibly additional documentation, depending on your new custodian's requirements. Once your request is submitted, follow up to ensure a smooth transition. This type of IRA gives you broader investment choices, helping you take control of your retirement savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.