Loading

Get Az For 650a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Az For 650a online

Filling out the Az For 650a form online is a straightforward process that allows users to report abandoned property efficiently. This guide provides a step-by-step approach to ensure that you complete the form accurately and thoroughly.

Follow the steps to complete the Az For 650a form online.

- Click ‘Get Form’ button to obtain the form in an editor where you can easily fill out the required information.

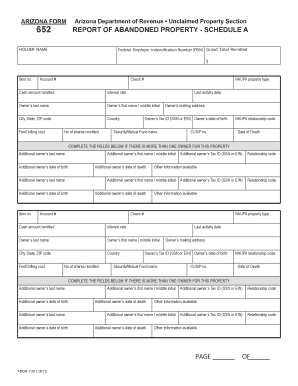

- Begin by entering the Federal Employer Identification Number (FEIN) in the designated field. This is a unique number assigned to your business by the IRS.

- Fill in the holder name, which should be the name of the person or entity that holds the property being reported.

- Enter the grand total remitted, which reflects the total cash amount associated with the abandoned property.

- Complete the item number and account number fields as needed for identification purposes.

- Indicate the check number used for the transaction related to the abandoned property.

- Select the NAUPA property type, which categorizes the type of abandoned property you are reporting.

- Provide the cash amount remitted for the property and fill in any applicable interest rate.

- Record the owner's last name, first name, and middle initial, along with their mailing address, city, state, ZIP code, and country.

- Include the owner's Tax ID, which may be either a Social Security Number (SSN) or Employer Identification Number (EIN), and the owner’s date of birth.

- For security or mutual fund reports, include the name and CUSIP number.

- Specify the NAUPA relationship code and any relevant date of death for the owner as necessary.

- If there is more than one owner, complete the additional owner fields with their relevant information, including their name, date of birth, and Tax ID.

- Review all entries for accuracy before proceeding to save changes, download, print, or share the form as required.

Get started on filling your Az For 650a form online today!

Form 5000 is the Arizona Resale Certificate used for making tax-exempt purchases, while Form 5000A is utilized by sellers for transactions exempt from transaction privilege tax. Each serves a distinct purpose in the sales process in Arizona and must be correctly identified to ensure compliance. Understanding these differences is crucial for businesses, and uslegalforms can help clarify the appropriate usage of these forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.