Loading

Get 5227 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5227 Form online

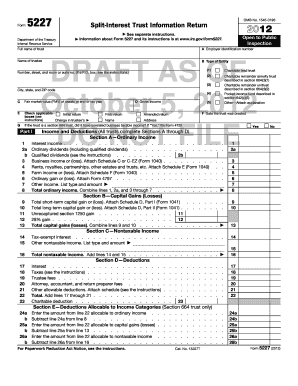

The 5227 Form, also known as the Split-Interest Trust Information Return, is essential for reporting income, deductions, and distributions for certain types of trusts. This guide will help you navigate each section and field of the form, ensuring a comprehensive online submission.

Follow the steps to complete the 5227 Form correctly.

- Press the ‘Get Form’ button to access and open the 5227 Form in your preferred editing tool.

- Begin by entering the full name of the trust and its employer identification number in the designated fields.

- Fill in the name of the trustee and provide the type of entity by checking the appropriate box for either a charitable lead trust, charitable remainder annuity trust, charitable remainder unitrust, or pooled income fund.

- Indicate the applicable return type by selecting initial return, change in trustee’s, final return, or amended return.

- Complete Section A regarding income and deductions which includes inputting ordinary income, capital gains, and allowable deductions, adhering to the specific line instructions provided.

- Proceed to Part II to fill out the schedule of distributable income, ensuring that you accurately calculate undistributed income and current year net income.

- In Part III, diligently record any distributions made for charitable purposes, making sure to provide comprehensive descriptions of payees and the nature of distributions.

- Continue to Part IV by detailing assets, ensuring you record beginning and end-of-year book values accurately.

- Complete Part V, if applicable, by providing any additional information regarding charitable remainder trusts, including fair market value of property.

- After completing all sections, review the form for accuracy. Once confirmed, proceed to save changes, download, print, or share the completed 5227 Form.

Complete your 5227 Form online today for a smooth filing experience.

The IRS allows a six-month extension for form 5227. To obtain this extension, you must file IRS form 8868 well before the original due date of your 5227 form. This extension can provide you with additional time to gather necessary information while avoiding late filing penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.