Loading

Get Fidelitycomtoa Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelitycomtoa form online

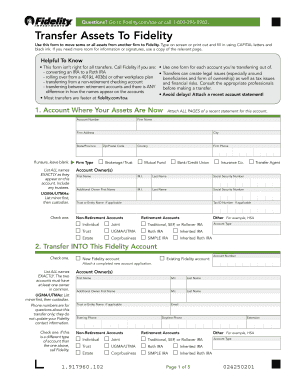

The Fidelitycomtoa form is designed to help users transfer assets from another firm to Fidelity. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Fidelitycomtoa form online.

- Press the ‘Get Form’ button to access the Fidelitycomtoa form and open it in your editor.

- Begin by filling in the account information where your current assets are held, including the account number, firm name, and address. Ensure details match the official documents precisely.

- Proceed to the section titled 'Transfer Into This Fidelity Account.' Check whether you are opening a new Fidelity account or transferring to an existing one. Include relevant owner details and contacts.

- In the 'Assets to Transfer to Fidelity' section, indicate if you wish to transfer the entire brokerage account or specify the assets you want to transfer. Fill in the required fields for each asset type accordingly.

- If there are differences in owner names or account types between the two accounts, complete the necessary steps and attach appropriate documentation to verify those differences.

- Finalize your form by reviewing the signatures and dates section. All owners must sign to validate the instructions provided on the form.

- Once completed, you can save your changes, download a copy, print the form, or share it as necessary.

Complete your documents online to ensure a smooth asset transfer process.

Fidelity requires various documents to process your requests, including identification and account-specific forms. Make sure to gather all necessary documentation ahead of time to ensure a smooth submission. If you're uncertain about any specific requirements for your Fidelitycomtoa Form, visiting the Fidelity website can clarify what you'll need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.