Loading

Get Notice Of Change For Quarterly Reporting Household Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice of Change for Quarterly Reporting Household form online

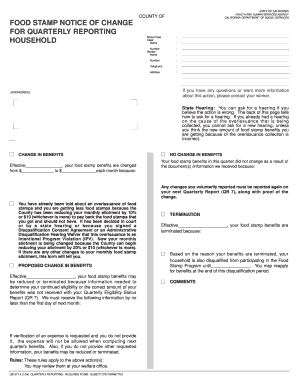

The Notice of Change for Quarterly Reporting Household form is essential for communicating changes in your food stamp benefits. This guide will help you understand how to accurately fill out this form online, ensuring you provide the necessary information for proper processing.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your notice date, case number, and the name of your worker in the designated fields. Ensure these details are correct, as they are crucial for identifying your case.

- Next, fill in your personal information, including your name, address, and telephone number. Accuracy here is vital, as it helps the department contact you regarding your benefits.

- Move to the section detailing changes in benefits. Select whether there is a change or no change in benefits, and fill in the necessary amounts where applicable. Be specific about the effective date of any changes.

- If applicable, provide any comments that might clarify your situation or inform the department about your circumstances. This can be beneficial for the assessment of your benefits.

- Proceed to the hearing request section if you believe the action taken is incorrect. Fill out your reasons for requesting a hearing if relevant.

- Review all entered information for accuracy and completeness. Ensure you've included all required details before proceeding.

- Once satisfied with your entries, save changes to the form. You may also download, print, or share the completed form as needed.

Complete your online form today to ensure your food stamp benefits are processed correctly.

Form 8986 is reported to the IRS along with your tax return. It's used to report income received from a pass-through entity and must be attached to your individual tax return, such as Form 1040. Ensure you follow the filing guidelines provided by the IRS. If you need additional help, the uslegalforms platform provides useful insights and templates that make this process easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.