Loading

Get Qp401k Hardship Application Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qp401k Hardship Application Distribution Form online

Navigating the Qp401k Hardship Application Distribution Form is essential for users seeking to request a distribution due to financial hardship. This guide will walk you through the form's components, ensuring a smooth online completion process.

Follow the steps to successfully complete the form online:

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

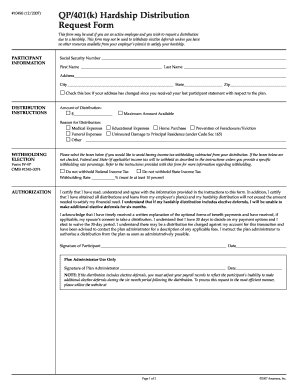

- In the Participant Information section, enter your Social Security number, first name, last name, and address. If your address has changed since your last participant statement, be sure to check the corresponding box.

- Proceed to the Distribution Instructions section. Specify the amount you wish to request for distribution. You can either enter a specific dollar amount or choose to receive the maximum amount available.

- Select the reason for your distribution from the provided options, which include medical expenses, educational expenses, home purchase, prevention of foreclosure/eviction, funeral expenses, uninsured damage to your principal residence under Code Sec 165, or other.

- In the Withholding Election section, indicate whether you wish to have federal or state income tax withheld from your distribution. You can opt not to withhold taxes by checking the respective boxes. If you want to specify a withholding rate, enter it in the provided space.

- Read and acknowledge the Authorization section. It requires your signature and the date to certify understanding of the information provided and the implications of the hardship distribution requested.

- After reviewing the form for completeness and accuracy, save your changes, then download, print, or share the form as needed.

Complete your Qp401k Hardship Application Distribution Form online today!

Fidelity's guidelines for hardship withdrawal closely align with general IRS rules. Qualifying situations often include significant medical expenses, tuition and educational fees, and other urgent financial needs. Using the Qp401k Hardship Application Distribution Form will ensure you provide all necessary details to Fidelity for a smooth withdrawal process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.