Loading

Get Tds Group 403b Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tds Group 403b Form online

The Tds Group 403b Form is essential for managing your retirement investments. This guide will provide you with a clear and straightforward method to complete the form online, ensuring you understand each section and field.

Follow the steps to complete your Tds Group 403b Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

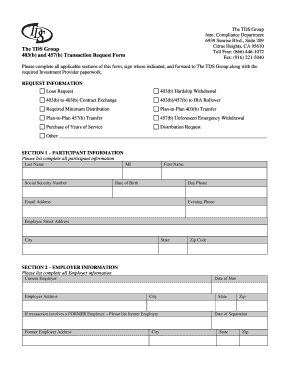

- Begin by filling out the Request Information section, where you will indicate the type of request you are making, such as a loan request or a hardship withdrawal.

- Complete Section 1, Participant Information. Here, provide your last name, first name, middle initial, social security number, date of birth, and contact details including both day and evening phone numbers, email address, and street address.

- Move to Section 2, Employer Information. Enter the name and address of your current employer, along with your date of hire. If applicable, provide information regarding any former employer.

- In Section 3, Investment Provider Information for Request, list the accounts you are requesting a transaction for. Include the account number, investment provider name, address, and approximate account value for each account.

- Fill out Section 4 if you have additional provider information that is not included in the current request. List any other 403(b) or 457(b) accounts, including the required details.

- Finally, review all completed sections for accuracy. Sign and date the form where indicated. Remember that incorrect or false information may lead to processing issues.

- Once complete, save your changes, download, print, or share the form as necessary along with the required Investment Provider paperwork.

Start filling out your Tds Group 403b Form online today to manage your retirement investments effectively.

You cannot set up a 403b account entirely on your own, as these plans are typically offered through employers. However, if your job provides one, you can usually choose your contributions and investment options. The Tds Group 403b Form can guide you through the setup process to ensure you take full advantage of this retirement planning tool.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.