Loading

Get Health Savings Account (hsa) Contribution Form - Hsa Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account (HSA) Contribution Form - HSA Bank online

Filling out the Health Savings Account (HSA) Contribution Form is an important step in managing your contributions effectively. This guide provides clear instructions to help you complete the form online with ease.

Follow the steps to complete the form accurately and efficiently.

- Press the 'Get Form' button to access the document and open it in the editor for completion.

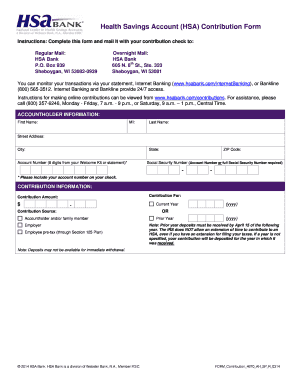

- Enter your personal information in the ACCOUNTHOLDER INFORMATION section. Fill in your first name, middle initial (if applicable), last name, street address, city, state, ZIP code, and account number found in your Welcome Kit or statement. Additionally, provide your Social Security number.

- In the CONTRIBUTION INFORMATION section, specify the Contribution For field to indicate the purpose of the contribution. You may choose to contribute for the current year or a prior year, ensuring that any prior year contributions are received by April 15 of the following year.

- Input the Contribution Amount in the designated field, using only numerical values and the dollar sign ($).

- Select the appropriate Contribution Source by indicating whether the funds come from you, a family member, or an employer via a pre-tax plan under Section 125.

- Review all entries for accuracy, then save your changes. Ensure that all required fields are completed to avoid processing delays.

- After finalizing your form, you may download and print it for your records, or follow the instructions to share it if required. Mail your completed form along with your contribution check to the appropriate address provided.

Complete your Health Savings Account contributions online today for streamlined management and tracking.

To report HSA contributions on your taxes, you must complete Form 8889 and include it with your tax return. This form details your contributions, distributions, and any penalties for excess contributions. Accurate reporting is crucial for ensuring that you meet all IRS requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.