Loading

Get Ftb 3805p Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3805p Form online

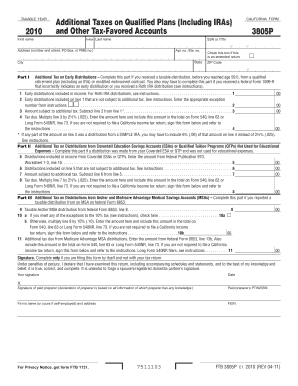

The Ftb 3805p Form is essential for reporting additional taxes related to qualified plans and other tax-favored accounts. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users understand each part of the document.

Follow the steps to accurately complete the Ftb 3805p Form online.

- Click the ‘Get Form’ button to access the form and open it in the editing interface.

- Begin by filling out the header information. Enter your first name, middle initial, last name, and either your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Additionally, provide your full address including the street number, city, state, and ZIP code.

- Indicate if this form is an amended return by checking the corresponding box if applicable.

- Proceed to Part I, where you will report any early distributions. Start with the total amount of early distributions included in income. For Roth IRA distributions, refer to the provided instructions for accuracy.

- On line 2, specify any distributions that are not subject to additional tax based on the exceptions outlined in the instructions. Make sure to provide the appropriate exception number.

- Calculate line 3 by subtracting line 2 from line 1. This will give you the amount subject to additional tax.

- For line 4, multiply the amount in line 3 by 2½% (0.025). Ensure this amount is included in your total on Form 540 or Long Form 540NR, as directed.

- Continue to sections for Coverdell Education Savings Accounts (ESAs) and Medicare Advantage Medical Savings Accounts (MSAs), completing the relevant lines as instructed for each type of distribution.

- Once all sections are completed, review your entries for accuracy. Ensure that you've filled in all necessary fields.

- Finally, save your changes, download the completed document, and consider printing or sharing the form, as needed.

Complete your Ftb 3805p Form online today to avoid any issues with your tax filings!

To fill out CA withholding forms, start by determining your filing status and any exemptions. Fill in personal information, and then calculate the correct withholding amount based on your income and deductions. Clear guidelines are available to support you, including the impact of passive losses noted in the Ftb 3805P Form, ensuring you withhold the right amounts throughout the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.