Loading

Get Etrade 1099

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Etrade 1099 online

Navigating the Etrade 1099 form can be straightforward with the right guidance. This user-friendly guide is designed to help you understand each section and complete your form efficiently and accurately.

Follow the steps to complete your Etrade 1099 online

- Click ‘Get Form’ button to obtain the Etrade 1099 form and open it for editing.

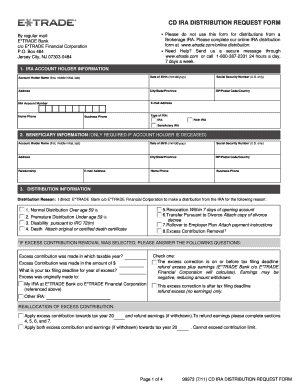

- Provide your personal information in the 'IRA Account Holder Information' section. Include your full name, date of birth, social security number, and current address, along with your email address and phone numbers.

- If the account holder is deceased, complete the 'Beneficiary Information' section with the required details of the beneficiary, including their relationship to the account holder.

- Fill out the 'Distribution Information' section. Here, specify the reason for the distribution by selecting one from the options provided, and answer any additional questions if you are correcting an excess contribution.

- In the 'Method of Distribution' section, indicate how you would like to receive your funds. Choices include a lump-sum, installment payments, or a partial payment.

- Complete the 'Optional Payment Instructions' if applicable, providing details for direct deposits or checks based on your preference.

- Fill out the 'Withholding Election' section to indicate whether you wish to withhold federal and/or state taxes from your distribution. This is an important step to ensure proper tax treatment of your funds.

- Finally, sign and date the form in the 'Signatures' section, confirming that the information provided is accurate and that you understand the withdrawal rules.

- After reviewing your completed form for accuracy, you can save your changes, download, print, or share the completed Etrade 1099 form as needed.

Take action now and complete your Etrade 1099 online easily today.

An Etrade 1099 is a tax form that reports income earned, such as dividends or capital gains from trading activities. When you receive this form, it indicates the earnings you need to report on your tax return. Understanding its purpose can help you accurately prepare your taxes and avoid complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.