Loading

Get Roth Ira Application - Fascore

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Roth IRA APPLICATION - FASCore online

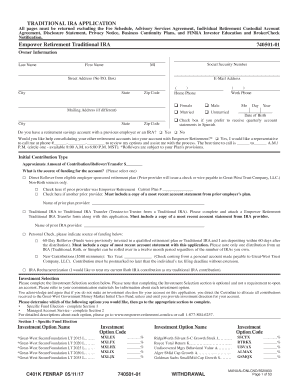

Filling out the Roth IRA Application online can seem daunting, but with the right guidance, the process can be straightforward. This guide provides step-by-step instructions to help users navigate each section of the Roth IRA Application effectively.

Follow the steps to accurately complete your Roth IRA Application online.

- Press the ‘Get Form’ button to acquire the Roth IRA Application and open it in your preferred editor.

- Fill in the owner information section with your last name, first name, social security number, and middle initial.

- Provide your complete address, including city, state, and zip code. If your mailing address differs from your residential address, indicate that as well.

- Include your email address and phone numbers for both work and home.

- Indicate your gender and marital status by selecting the appropriate checkboxes.

- Enter your date of birth in the specified format.

- Decide if you would like your statements in Spanish and select the respective checkbox if applicable.

- If applicable, answer if you have retirement accounts or IRAs and authorize contact for assistance.

- Select the type of initial contribution, providing the approximate amount and source of funding for the account.

- Complete the Investment Selection section if you choose to specify investment options; otherwise, your contributions will be allocated to the default option.

- Designate beneficiary information if required, ensuring that entries total 100%.

- Review all entries for accuracy and ensure that no sections are left incomplete.

- Save your changes, and once finalized, download, print, or share the application as needed.

Start filling out your Roth IRA Application online today and secure your financial future!

Typically, you need to have earned income to contribute to a Roth IRA. If you do not work, contributions may not be possible unless you have other sources of earned income. The Roth IRA APPLICATION - FASCore can help you understand your options and create a pathway for savings, even if employment is currently not part of the equation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.