Loading

Get Scannable 1099 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

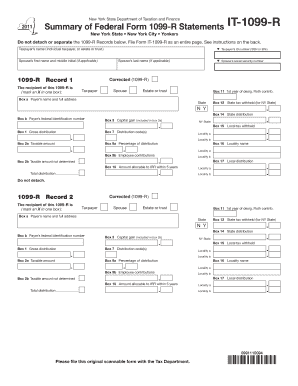

How to fill out the Scannable 1099 Form online

Filling out the Scannable 1099 Form can be straightforward if you understand its components and how to complete each section. This guide aims to provide a clear and user-friendly approach to assist you in submitting this important tax document online.

Follow the steps to fill out the Scannable 1099 Form online with ease.

- Press the ‘Get Form’ button to access the Scannable 1099 Form and open it in the designated editor.

- Begin by entering the taxpayer’s ID number, which can be either a Social Security Number (SSN) or Employer Identification Number (EIN).

- Input the taxpayer’s name in the designated field, followed by the spouse’s first name and middle initial if applicable.

- Enter the spouse’s last name in the next field if applicable.

- For each 1099-R Record, mark an X in the appropriate box to indicate whether the recipient is the taxpayer, spouse, or an estate or trust.

- Fill out Box a with the payer’s name and complete address as it appears on the federal Form 1099-R.

- Input the payer’s federal identification number in Box b.

- Refer to the federal Form 1099-R and input relevant amounts in the corresponding numbered boxes, such as gross distribution in Box 1, taxable amounts in Box 2a, and state tax withheld in Box 12.

- If applicable, mark additional boxes that correspond to the information provided on the federal Form 1099-R, including any corrected entries.

- Complete any additional 1099-R Record sections if required, ensuring that each box is filled as per the federal Form guidelines.

- Once all information is completed, save your changes. You can then download, print, or share the completed form as necessary.

Start filling out your Scannable 1099 Form online today to ensure timely and accurate submission.

Yes, Staples does provide 1099 forms, including scannable options. However, it's important to verify whether the specific version you need, such as the scannable 1099 form, is in stock. If you prefer a reliable source, consider checking online services like USLegalForms for more choices and convenience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.