Get Iracmbdislaz

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iracmbdislaz online

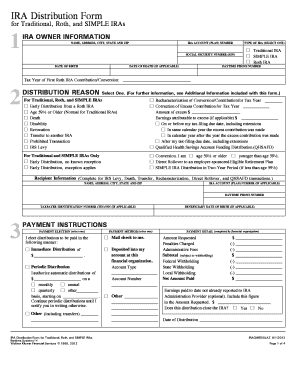

The Iracmbdislaz form is essential for managing distributions from Traditional, Roth, and SIMPLE IRAs. This guide will help users navigate each section of the form with clear instructions to ensure accurate and complete submissions.

Follow the steps to successfully complete the Iracmbdislaz form online.

- Click ‘Get Form’ button to access the Iracmbdislaz form and open it in your preferred online document editor.

- In the 'IRA owner information' section, provide your full name, address, city, state, and ZIP code. Ensure all details are accurate.

- Enter your IRA account (plan) number and Social Security number (SSN) in the designated fields to confirm your identity.

- Include your date of birth and, if applicable, the date of death of the IRA owner. This information helps in maintaining accurate records.

- Select the type of IRA from the options provided: Traditional IRA, SIMPLE IRA, or Roth IRA. Choose only one type.

- Fill in the daytime phone number where you can be reached for any questions related to your form.

- Specify the tax year of your first Roth IRA contribution or conversion, if applicable.

- Select the reason for distribution from the list provided. This helps the financial institution understand your request.

- If the distribution applies to a Traditional or SIMPLE IRA, indicate whether it is an early distribution with or without exceptions.

- Complete the recipient information if the distribution is due to an IRS levy, death, transfer, recharacterization, direct rollover, or Qualified Health Savings Account funding distribution.

- Choose your payment instructions. Select how you want to receive the distribution, whether by mail, immediate distribution, or other options as specified.

- Indicate the payment details as required, including amounts requested and withholding preferences.

- Read and sign the certification section to confirm that the information is accurate and that you authorize this transaction.

- Finally, save your changes, and you may download, print, or share the completed form as necessary for your records.

Start filling out the Iracmbdislaz form online today to manage your IRA distribution!

The rollover rule allows you to transfer funds from one retirement account to another without incurring taxes, but certain conditions apply. A common loophole involves the 60-day rule, which permits you to withdraw funds and redeposit them into another IRA within 60 days without penalties. Be cautious, as failing to follow this rule can result in significant tax consequences. Utilizing the Iracmbdislaz framework can help you navigate these intricacies effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.