Loading

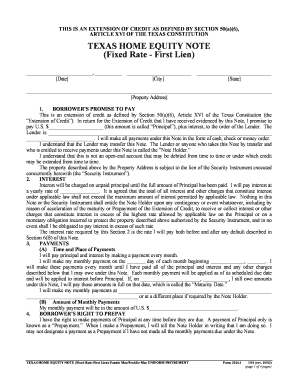

Get Texas Home Equity Note - Fixed Rate - First Lien (form: 3244.1):pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Home Equity Note - Fixed Rate - First Lien (Form: 3244.1):PDF online

Filling out the Texas Home Equity Note can seem daunting, but this guide will provide you with step-by-step instructions to complete the form correctly online. It is important to ensure all information is accurate to comply with Texas regulations.

Follow the steps to fill out the Texas Home Equity Note - Fixed Rate - First Lien form with ease.

- Click ‘Get Form’ button to access the Texas Home Equity Note form and open it in your preferred PDF editor.

- Begin by entering the date and city where the document is being executed, along with the state where the property is located.

- Fill in the property address in the designated area, ensuring the details match the legal description of the property.

- In the 'Borrower’s promise to pay' section, write the principal amount being borrowed and name the lender carefully.

- Specify the annual interest rate that will apply to the borrowed principal in the 'Interest' section, ensuring compliance with applicable laws.

- Indicate the beginning payment date and the amount of your monthly payment in the 'Payments' section.

- Complete the 'Borrower’s right to prepay' section to outline your plan for any early payments on the principal.

- Fill in the details regarding any loan charges according to the terms specified in the 'Loan Charges' section.

- Specify any late charges for overdue payments, including percentage rates in the relevant section.

- Review each section for accuracy, ensuring all fields are filled, before proceeding to sign the document in the 'Signature' section.

- Once completed, save your changes, and you may also download, print, or share the document as needed.

Complete your form online to ensure a smooth loan process today!

In Texas, home equity lending is governed by several strict rules designed to protect homeowners. A borrower must meet certain eligibility criteria, and the equity amount cannot exceed 80% of the home's appraised value. Additionally, lenders must provide clear disclosures about the terms and costs involved. The Texas Home Equity Note - Fixed Rate - First Lien (Form: 3244.1):PDF serves as a vital document in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.