Get Ny Form Ct 51

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ny Form Ct 51 online

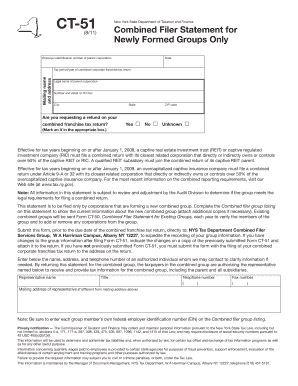

Filling out the Ny Form Ct 51 is essential for newly formed groups seeking to file a combined corporate franchise tax return. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Ny Form Ct 51 online.

- Press the ‘Get Form’ button to obtain the form and access it for filling out.

- Enter the employer identification number of the parent corporation in the designated field.

- Provide the mailing name and address for the parent corporation, ensuring all information is accurate.

- Specify the date related to the submission of the form.

- Indicate the tax period or year for the combined corporate franchise tax return.

- Fill in the legal name of the parent corporation, including the street address or P.O. box, city, state, and ZIP code.

- Answer whether you are requesting a refund on the combined franchise tax return by marking an 'X' in the appropriate box.

- Complete the Combined filer group listing by entering the federal employer identification numbers for each member in the group.

- Provide the name, title, mailing address, telephone number, and fax number of an authorized representative for the combined group.

- Review all the information entered for accuracy before submitting the form.

- Once finished, users can save changes, download, print, or share the form as required.

Complete your Ny Form Ct 51 online today to ensure your group is properly represented.

In New York, S Corporations must adhere to both state and federal requirements, including maintaining their S status and filing necessary tax returns. They enjoy benefits like pass-through taxation, where income is taxed on the shareholders’ personal tax returns instead of the corporate level. To navigate these rules effectively, turn to US Legal Forms for templates and advice tailored specifically to S Corporations in New York.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.