Loading

Get Texas Direct Pay Permit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Direct Pay Permit Form online

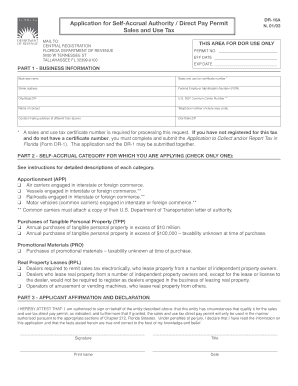

The Texas Direct Pay Permit Form is essential for businesses seeking self-accrual authority regarding sales and use tax. This guide provides clear, step-by-step instructions to help users successfully complete the form online.

Follow the steps to complete the Texas Direct Pay Permit Form online.

- Click ‘Get Form’ button to obtain the Texas Direct Pay Permit Form and open it for editing.

- In Part 1, enter your business information including business name, street address, and federal employer identification number (FEIN). Ensure that your sales and use tax certificate number is filled in, as it is required for processing. If you do not have this number, you must submit the Application to Collect and/or Report Tax in Texas.

- For Part 2, select the appropriate self-accrual category for your business by checking only one option. Categories include Apportionment for carriers engaged in commerce, or Purchases of Tangible Personal Property for those exceeding certain purchase thresholds.

- In Part 3, complete the affirmation and declaration section by signing, dating, and printing your name. Make sure to indicate your title. This confirms your authorization to sign on behalf of your entity and attests to the accuracy of the application information.

- If applicable, attach any required documentation, such as a copy of your U.S. Department of Transportation letter of authority for common carriers applying under the apportionment category.

- Finally, you can save changes to your form, download a copy, print it, or share it according to your needs before submitting it to the Central Registration at the provided address.

Complete your documents online today for efficient processing.

Getting a vendor permit in Texas involves several straightforward steps. First, complete the Texas Direct Pay Permit Form, which allows you to make direct purchases without paying sales tax up front. This permits you to manage your sales tax responsibilities more effectively. By following the guidelines provided by the state and using resources like uslegalforms, you can simplify the application process and ensure your business is compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.