Loading

Get Nebraska Department Of Revenue Form 6

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Department Of Revenue Form 6 online

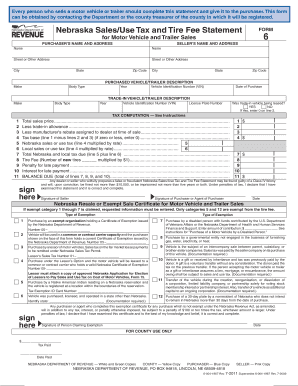

Completing the Nebraska Department of Revenue Form 6 online can streamline the process of declaring sales and use tax for motor vehicle and trailer sales. This guide provides you with clear, step-by-step instructions to assist you in filling out the form accurately and efficiently.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the purchaser’s name and address along with the seller’s name and address. Ensure that all required fields are completed correctly.

- In the section titled 'Purchased Vehicle/Trailer Description,' provide details about the vehicle including the make, body type, year, vehicle identification number (VIN), and date of purchase.

- If applicable, fill out the 'Trade-In Vehicle/Trailer Description' with the relevant details if you are trading in a vehicle. Include the make, body type, year, VIN, and license plate number.

- Indicate whether the trade-in vehicle was being leased by selecting either 'YES' or 'NO.' If 'YES,' you will need to enter 0 on the designated line.

- Proceed to the 'Tax Computation' section. Calculate the total sales price and record it on line 1. Subtract the trade-in allowance and any manufacturer’s rebate assigned to the dealer at the time of sale. Record this information in lines 2 and 3.

- Calculate the tax base by subtracting the trade-in allowance and manufacturer’s rebate from the total sales price. Enter this amount on line 4.

- For line 5 and line 6, calculate the Nebraska and local sales or use tax by multiplying the tax base by the respective rates. Record the sums on their respective lines.

- Add up lines 7, 8, 9, and 10 to determine the total amount due, which you will enter on line 11.

- Sign where indicated as the seller and have the purchaser or their agent sign as well. Input the date of signing.

- Once all fields are completed and double-checked, save your changes, and you can download, print, or share the form as needed.

Complete your documents online today to ensure a smooth filing process.

Related links form

You can contact the Nebraska Department of Revenue through their official website, where you will find phone numbers and email addresses for different departments. They also have a contact form that you can fill out for inquiries. Whether you have questions about taxes or specific forms like the Nebraska Department Of Revenue Form 6, they are available to assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.