Loading

Get Form To Be Faxed With Rev72

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form To Be Faxed With Rev72 online

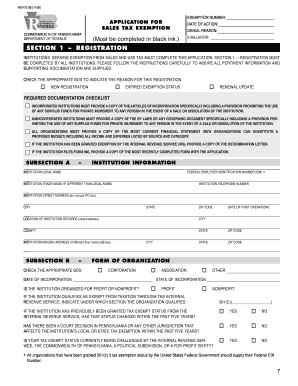

This guide provides comprehensive instructions on completing the Form To Be Faxed With Rev72 efficiently and accurately. Follow the outlined steps to ensure that your application meets the necessary requirements for sales tax exemption.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the Form To Be Faxed With Rev72. This will allow you to open the form in your preferred editor.

- In Section 1 – Registration, indicate whether you are applying for a new registration, renewal update, or if your exemption status has expired. Mark the corresponding box clearly.

- Provide all required institutional information in Subsection A. Include the legal name, federal EIN, and the institution's trade name if applicable. Ensure all entries are in black ink.

- Complete Subsection B by selecting the appropriate form of organization. If applicable, indicate whether the institution is nonprofit or for-profit, and provide details regarding the IRS exemption status.

- In Subsection C, provide a detailed description of the institution's activities over the past three years, including how beneficiaries are selected.

- If applicable, detail any affiliate relationships in Subsection D, including ownership percentages and the type of organization.

- Complete Subsection E by listing all officers of the institution along with their compensation and benefits, attaching additional sheets if necessary.

- Provide the salary information of the highest-paid individuals in Subsection F and attach any pertinent documentation.

- In Section 2, complete the financial information by addressing income sources, expenses, and relevant questions as applicable to your organization.

- After thoroughly reviewing the completed form, save any changes you have made. You may then download, print, or share the form as necessary.

Complete your application for sales tax exemption today to ensure your institution is properly registered.

Yes, form 8822 B can be faxed to the IRS. Ensure that you follow the specific instructions for faxing, including providing all required information and signatures, to make the process smooth. When you fax this form to be faxed with Rev72, be proactive in checking for any updates from the IRS. Utilizing USLegalForms can help guide you through the requirements easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.