Loading

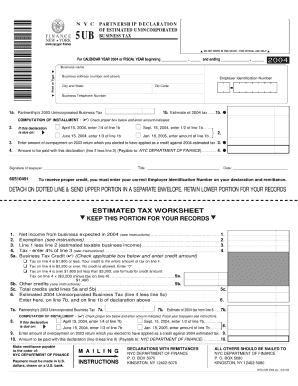

Get Nyc 5ub 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 5ub 2013 Form online

Filling out the Nyc 5ub 2013 Form online can streamline the process and save time. This guide provides comprehensive steps and detailed instructions to help users complete the form accurately.

Follow the steps to fill out the Nyc 5ub 2013 Form seamlessly online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This typically includes your name, address, and contact details. Ensure all information is accurate and up-to-date.

- Proceed to the section that requires details relevant to the purpose of the form. Carefully read the instructions and enter the necessary information, paying attention to each specific field.

- Review each section of the form thoroughly. Verify that all entries are correct and complete. Mistakes can lead to delays in processing.

- Once you have filled out the form, choose your preferred method to save your work. You can save the changes, download a copy of the form, print it out, or share it as required.

Complete your documents online now for streamlined processing.

The NYC UBT credit is generally not refundable, meaning it can only reduce your tax liability to zero, but not result in a refund. However, if you have overpaid, you can carry the excess credit forward to future tax filings. Understanding these nuances can aid in effective tax planning and decision-making for your business, especially when using the NYC 5UB 2013 Form. For clarity, consulting with a tax professional can also be beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.