Loading

Get Nyc 202

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 202 online

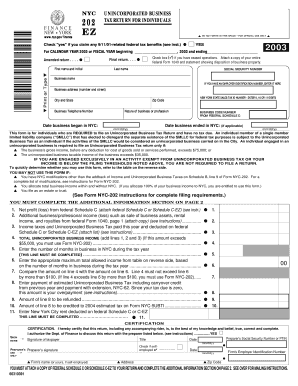

Filling out the Nyc 202 form is essential for individuals engaged in unincorporated businesses in New York City. This guide provides clear step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Nyc 202 form online.

- Press the ‘Get Form’ button to access the form and open it in the designated editor.

- Begin by entering your first name and initial, followed by your last name in the appropriate fields. Ensure to print or type clearly.

- Provide your Social Security Number and, if applicable, your Employer Identification Number. Fill in your business name and address, including city, state, and zip code.

- Enter your business phone number and select the nature of your business from the provided options.

- Indicate the date your business began and, if applicable, the date it ended in New York City, using the mm/dd/yy format.

- Complete the lines for net profit from federal Schedule C by attaching necessary documentation. Make sure all relevant information is included.

- Calculate and input your total unincorporated business income by adding net profit and any additional business income.

- Enter any estimated Unincorporated Business Tax payments and any refunds you expect. Verify the amounts to ensure accuracy.

- In the certification section, sign and date the form, confirming that all information provided is accurate and complete. Include preparer information if applicable.

- Once completed, save your changes. You can then download, print, or share the form as needed.

Complete your Nyc 202 filing online today to ensure compliance and timely submission.

Yes, if you earn income from a New York source but reside elsewhere, you must file a New York non-resident tax return. This applies to income earned from employment, business, or property in NYC. To ensure compliance and accuracy, consider consulting the resources available on USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.