Get M 990t 62 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M 990t 62 instructions online

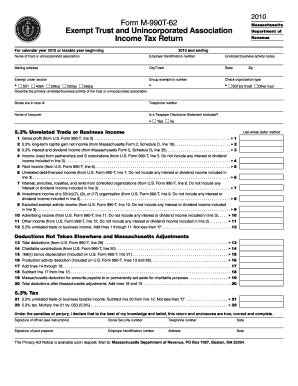

Filling out the M 990t 62 instructions online can be a straightforward process if you follow a clear set of steps. This guide provides detailed instructions tailored to users of all experience levels, ensuring you can complete your form accurately and efficiently.

Follow the steps to complete the M 990t 62 instructions online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the name of your trust or unincorporated association in the designated field at the top of the form.

- Enter your employer identification number (EIN) in the corresponding box.

- Provide the mailing address, including city/town, state, and zip code.

- Select the relevant unrelated business activity codes that apply to your organization.

- State the primary unrelated business activity in the field provided.

- Indicate whether a Taxpayer Disclosure Statement is enclosed by selecting 'Yes' or 'No.'

- Fill in the specific income details, using whole dollar amounts for various categories, including gross profit and income from partnerships, as outlined in the form.

- Complete the deductions section, ensuring to include any adjustments specific to Massachusetts.

- Calculate your tax liability based on the taxable income outlined in the previous sections.

- Review all sections, ensuring accuracy in the details provided.

- Once the form is complete, save your changes, and you may choose to download, print, or share the form as needed.

Take the next step in your financial management by completing your M 990t 62 instructions online today.

Related links form

Form 990 is an annual information return that tax-exempt organizations must file to provide the IRS with details about their activities, finance, and governance. In contrast, Form 990-T specifically addresses unrelated business income tax, which is applicable when tax-exempt organizations generate income from non-related business activities. Therefore, while both forms are related to tax-exempt organizations, the M 990t 62 Instructions focus specifically on the tax implications of unrelated business income that necessitate the filing of Form 990-T. Understanding this distinction can help organizations plan better and maintain compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.