Loading

Get Cwf1 Becoming Self-employed And Registering For National ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

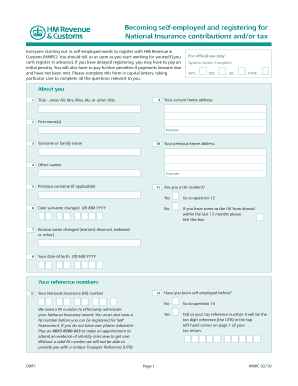

How to fill out the CWF1 becoming self-employed and registering for National Insurance online

Filling out the CWF1 form is an essential step for individuals who are transitioning to self-employment. This guide provides clear instructions on completing the form online, ensuring that you register accurately and efficiently.

Follow the steps to complete the CWF1 form successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'About you' section, fill in your title, first name(s), surname or family name, and any other names. Make sure to complete all fields accurately.

- Provide your current home address along with the postcode. If applicable, include your previous home address and its postcode.

- Indicate any previous surnames and the date of the name change if it applies to you.

- Enter your date of birth accurately in the specified format.

- Answer the question regarding your UK residency. If you have moved to the UK within the last 12 months, tick the corresponding box.

- Provide your National Insurance number. If you do not have one, note the instructions for how to obtain it from Jobcentre Plus.

- Indicate whether you have been self-employed before. If yes, provide your tax reference number.

- In the 'About your business' section, specify when you started working for yourself and the name of your business. If your business does not have a name, you may leave that box blank.

- Detail the type of self-employed work you do, and indicate if you have business partners. Each partner must complete a separate CWF1 form.

- If relevant, fill in your business address or leave it blank if it's the same as your home address.

- Provide a business phone number, if different from your daytime phone number.

- Follow the instructions regarding how to pay your Class 2 National Insurance contributions, including options for direct debit.

- If you want to receive additional materials, such as the starting up in business guide or information on employing others, tick the relevant boxes.

- Sign and date the form before submitting.

- Send the completed form to the specified address for the National Insurance Contributions Office.

Take the next step in your journey by completing your CWF1 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you are self-employed, you typically need to fill out the CWF1 form for tax purposes. This includes reporting your business income and expenditures accurately. It's crucial to maintain thorough records to ensure your self-assessment is comprehensive and includes all relevant details. For a thorough understanding of this process, consult 'CWF1 Becoming Self-employed And Registering For National ....' for expert help.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.