Get Capital Gains Summary Notes 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Capital Gains Summary Notes 2012 Form online

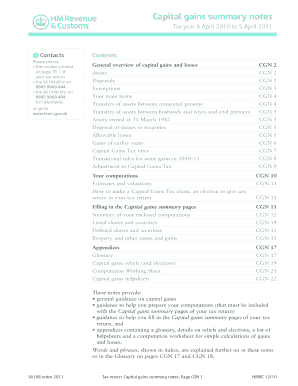

The Capital Gains Summary Notes 2012 Form is essential for individuals reporting their capital gains for the tax year. Filling it out correctly ensures that you comply with tax regulations while maximizing any potential deductions. This guide provides clear, step-by-step instructions to assist you in completing the form online.

Follow the steps to successfully fill out the Capital Gains Summary Notes 2012 Form online.

- Click ‘Get Form’ button to obtain the Capital Gains Summary Notes 2012 Form and open it in the editor.

- Begin by entering your personal information at the top of the form, including your name, address, and tax identification number.

- In the section for listed shares and securities, input the number of disposals in box 16, followed by the total disposal proceeds in box 17.

- Next, detail the allowable costs associated with your disposals in box 18, which include purchase prices and any associated fees.

- Calculate and enter the total gains for listed shares and securities in box 19, ensuring that any relevant reliefs or claims are considered.

- Proceed to unlisted shares and securities by repeating steps 16 through 19 for that section.

- In the property and other assets section, fill in boxes 28 to 31 with the corresponding information regarding the number of disposals, proceeds, allowable costs, and gains.

- After completing the above sections, summary information in boxes 3 to 15 should then be filled out, reflecting total gains, losses, and adjustments.

- Carefully review all entries for accuracy and completeness before proceeding to save your work.

- Finally, save changes, download, print, or share your completed Capital Gains Summary Notes 2012 Form as needed.

Complete your Capital Gains Summary Notes 2012 Form online to ensure compliance and maximize your refunds!

To report capital gains, you typically fill out IRS Form 8949 and the associated Capital Gains Summary Notes 2012 Form. These forms help you document your transactions and calculate your overall gain or loss. If you have any questions about filling them out, uslegalforms provides comprehensive resources to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.