Loading

Get Form 531 Cumberland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 531 Cumberland online

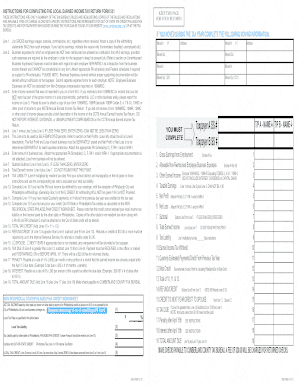

Filling out Form 531 Cumberland online can seem daunting, but with careful guidance, the process can be straightforward. This guide offers step-by-step instructions tailored to assist users of all experience levels in completing this tax form accurately.

Follow the steps to fill out the Form 531 Cumberland online.

- Press the ‘Get Form’ button to obtain the form and open it in the applicable online editor.

- In Line 1, list your gross earnings, including wages, salaries, and commissions, from any source. Attach a copy of your W-2 forms for verification.

- In Line 2, if applicable, detail any unreimbursed business expenses that were necessary for your employment, ensuring you provide appropriate documentation for each employer separately.

- For Line 3, include any income that was not reported on a W-2. If you have 1099 forms for such income, attach them as proof.

- Calculate Line 4 by subtracting Line 2 from Line 1 and adding Line 3. If the result is less than zero, enter zero.

- Self-employed individuals will report their net profits in Line 5. Ensure to separately state the net profit or loss for each business activity.

- In Line 6, enter any applicable business loss and attach the relevant schedules.

- For Line 7, calculate the subtotal by subtracting Line 6 from Line 5. If this is less than zero, enter zero.

- Line 8 adds Line 4 and Line 7 to determine your total earned income.

- Line 9 calculates the tax liability by multiplying Line 8 by your municipality's tax rate.

- In Line 10, report any local income tax withheld by your employer; this must be shown on your W-2.

- Line 11 should reflect any quarterly payments made or any refund credits from the previous tax year.

- For Line 12, enter any applicable prior year credit or out-of-state tax credits, ensuring to attach necessary forms.

- Add Lines 10, 11, and 12 to determine the total tax credit for Line 13.

- In Line 14, if the total tax credit exceeds your tax liability, subtract Line 9 from Line 13 to find any refund amount.

- Line 16 calculates the tax due if Line 9 is greater than Line 13.

- Review Lines 17 and 18 regarding any penalties or interest for unpaid taxes.

- Finally, report the total amount due in Line 19 as the sum of Lines 16, 17, and 18. Save your completed form. You can download, print, or share it as necessary.

Complete your Form 531 Cumberland online today to ensure a smooth filing process.

Filling out an availability form requires you to provide your current schedule. List the days and times you are available for the services related to Form 531 Cumberland. Clear and concise information will help facilitate the process and ensure you receive timely responses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.