Loading

Get Form 8875

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8875 online

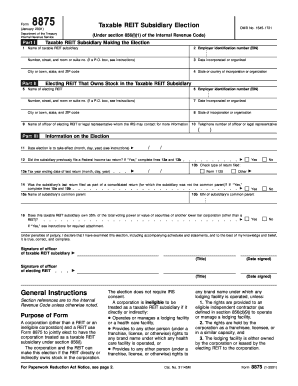

The Form 8875 is essential for entities electing to have a corporation treated as a taxable REIT subsidiary. This guide provides a clear and comprehensive overview of how to complete the form online, ensuring you understand each component and step.

Follow the steps to accurately complete Form 8875 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In Part I, enter the name of the taxable REIT subsidiary in the designated field. Ensure you provide the correct Employer Identification Number (EIN), as well as the date incorporated or organized, along with the complete address including city, state, and ZIP code.

- Continue filling out Part II by providing the name of the electing REIT and its EIN. Complete the address fields, including the date incorporated or organized, city, state, and ZIP code.

- List the name and telephone number of an officer or legal representative of the electing REIT in the respective fields.

- Proceed to Part III by entering the date when the election is intended to take effect. Answer whether the subsidiary has previously filed a Federal income tax return and if applicable, fill in the relevant tax year information.

- Respond to whether the subsidiary's last return was filed as part of a consolidated return. If yes, provide the common parent’s name and EIN.

- Indicate if the taxable REIT subsidiary owns 35% or more of another corporation's voting power or value and attach the required statement if applicable.

- Complete the form with the signatures of authorized officers from both the taxable REIT subsidiary and the electing REIT along with the respective dates signed.

- After reviewing all the provided information for accuracy, save your changes, and download or print the completed form for filing.

Complete your Form 8875 online today for accurate filing.

Form 8875 , Taxable REIT Subsidiary Election, is used by an eligible corporation and a REIT to jointly elect to have the corporation treated as a taxable REIT subsidiary. Such election can only be revoked with the consent of both the REIT and the subsidiary (IRC § 856(l)(1) ).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.