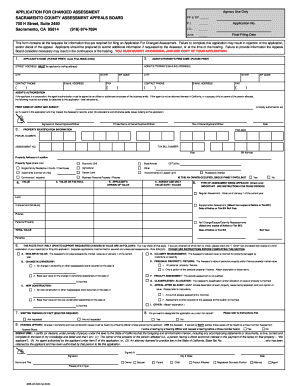

Get Application For Changed Assessment Sacramento County And Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Changed Assessment Sacramento County And Form online

This guide provides clear and systematic instructions for completing the Application For Changed Assessment in Sacramento County. Designed for users with varying levels of experience, it breaks down each component to assist you in submitting your form online accurately and effectively.

Follow the steps to complete your application with ease

- Click the ‘Get Form’ button to access the Application For Changed Assessment form and open it in your preferred editor.

- Fill in the applicant's name in the designated field, including last name, first name, and middle initial as applicable.

- Provide the agent or attorney's mailing address correctly. Ensure that the street address is the applicant's mailing address.

- Complete the contact information fields, including the city, state, ZIP code, phone number, fax number, and email address for the applicant.

- If applicable, fill out the agent's authorization section, including the printed name of the agent and their agency, along with the owner's signature.

- Enter property identification information such as parcel number, tax bill number, and assessment number in the respective fields.

- Indicate the property type by checking the appropriate box for the category that fits your property.

- Provide both the value on tax roll and your opinion of value in the designated fields under the value section.

- Select the type of assessment being appealed by marking the correct checkbox. Make sure to attach any required notices or tax bills.

- In the section regarding facts to support requested changes in value, check the applicable options that pertain to your situation.

- If a hearing is requested, specify your preferences in the appropriate section regarding the hearing officer.

- Finally, provide your signature, print your name and title, and confirm the information is complete and accurate before submitting.

- Once all sections are filled out, save any changes you have made. You may then download, print, or share the form as needed for submission.

Start your document submission online to ensure your application is processed efficiently.

Property taxes in Sacramento County are calculated based on your property's assessed value and the tax rate. The assessed value is determined by the Sacramento County Assessor, taking into account factors like market value and improvements made to your property. To better understand your specific situation, reviewing the Application For Changed Assessment Sacramento County And Form can provide insights into potential adjustments to your assessment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.