Loading

Get Form 593 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 593 Fillable online

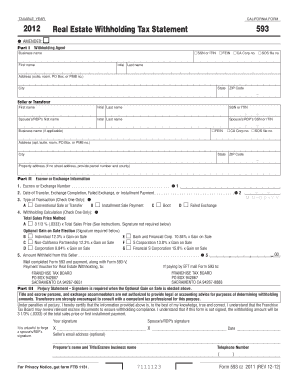

This guide provides clear instructions on how to successfully complete the Form 593 Fillable online. The form is essential for reporting withholding on real estate transactions and is designed to be user-friendly for all individuals, regardless of their legal expertise.

Follow the steps to fill out the Form 593 Fillable online

- Press the ‘Get Form’ button to obtain the Form 593 Fillable and open it in your editor.

- In Part I, enter the information for the withholding agent. Fill in the name, address, and appropriate identification numbers such as SSN or ITIN. This section is crucial as it identifies the party responsible for the withholding.

- Next, provide the seller or transferor's details. You need to include their name, address, and identification number. If applicable, list the spouse's or registered domestic partner’s information.

- In Part II, input the escrow or exchange information. Detail the escrow or exchange number, date of transfer, and select the type of transaction by checking the appropriate box.

- Calculate the withholding amount using either the total sales price method or the optional gain on sale election method. Make sure to check only one box and follow the instructions for each calculation.

- In Part III, complete the perjury statement. A signature is required here only if you have chosen the optional gain on sale election method. Ensure all parties involved in the transaction have signed where necessary.

- After reviewing the form for accuracy, you can save any changes made to the form. Download it, print it out, or share it as needed. Make sure to follow the submission guidelines for the completed form.

Complete your Form 593 Fillable online today for efficient real estate withholding reporting.

Filling out a PDF tax form involves opening the document with a compatible PDF viewer and entering the necessary information in designated fields. It is important to follow the instructions provided on the form carefully. Utilizing a Form 593 Fillable template from uslegalforms can streamline this process by allowing you to enter data digitally.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.