Loading

Get Tc 719

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 719 online

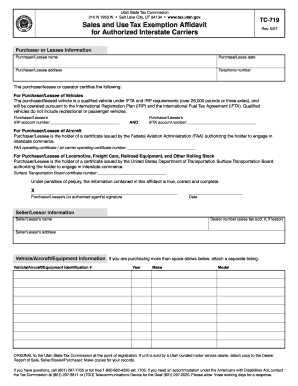

The Tc 719 form, also known as the Sales and Use Tax Exemption Affidavit for Authorized Interstate Carriers, is essential for individuals or businesses seeking tax exemptions when purchasing certain vehicles, aircraft, or equipment. This guide will take you through the process of filling out the Tc 719 online, ensuring that you complete each section accurately and effectively.

Follow the steps to complete the Tc 719 form online:

- Begin by clicking the ‘Get Form’ button to access the Tc 719 form. This will open the document in an online editor where you can fill it out seamlessly.

- In the 'Purchaser or Lessee Information' section, provide the name, purchase or lease date, address, and telephone number of the purchaser or lessee.

- If you are a purchaser or lessee of vehicles, confirm that the vehicle qualifies under IFTA and IRP requirements (over 26,000 pounds or three axles) and provide your IRP account number and IFTA account number in the designated fields.

- For purchasers or lessees of aircraft, indicate that the holder has an FAA certificate for interstate commerce and enter the FAA operating certificate number.

- If applicable, for purchasers or lessees of locomotives or railroad equipment, enter the Surface Transportation Board certificate number.

- Sign the form in the specified area to certify that the information provided is true, correct, and complete.

- Complete the 'Seller/Lessor Information' by entering the name, dealer number, and address of the seller or lessor.

- Fill out the 'Vehicle/Aircraft/Equipment Information' section with the identification number, year, make, and model of the purchased or leased item. If more space is needed, attach additional documentation.

- Once all sections are filled out correctly, save your changes. You can then download, print, or share the completed form as needed.

Complete the Tc 719 form online today to secure your tax exemption.

To file Utah sales tax online, register with the Utah State Tax Commission and gather your sales records. Follow the guidelines set forth in TC 719 to report your sales accurately. Online platforms make this process efficient; consider using UsLegalForms for a seamless online filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.