Loading

Get 2011 Ca Ftb Form 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Ca Ftb Form 100 online

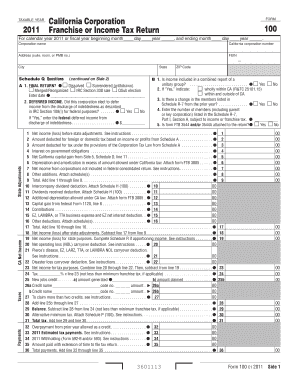

This guide provides a comprehensive overview of how to effectively complete the 2011 California Franchise Tax Board Form 100 online. It offers clear, step-by-step instructions designed to support users of all experience levels in navigating this important tax form.

Follow the steps to complete the 2011 Ca Ftb Form 100 online.

- Use the ‘Get Form’ button to access the form online and open it for editing.

- Fill in the corporation's name, number, address, city, state, and Federal Employer Identification Number (FEIN) in the designated fields at the top of the form.

- Indicate the tax year, either calendar year 2011 or fiscal year, by marking the appropriate boxes and entering the corresponding dates.

- Proceed to Schedule Q and answer the questions regarding your corporation's taxation circumstances, indicating 'Yes' or 'No' as necessary.

- Complete the sections regarding income, deductions, and tax calculations, ensuring to follow any instructions related to required attachments or additional forms.

- Review the Payments section to enter any prior year overpayment credits, estimated tax payments, and other applicable amounts.

- Fill out the Refund or Amount Due section, calculating any tax due or overpayment accurately.

- Finalize your form by signing where indicated, providing the necessary contact information, and confirming the accuracy of your entries.

- Once all fields are completed, save your changes, download the form, and either print or share it as needed.

Complete your tax documents online with confidence today.

To send California form 100, you must mail it to the address specified on the form's instruction page. The address varies depending on whether you are submitting it with payment or not. Using tools from USLegalForms can help you find the correct mailing address and ensure that your 2011 CA FTB Form 100 is sent to the right place promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.