Loading

Get 2011 Amended 540x Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Amended 540x Form online

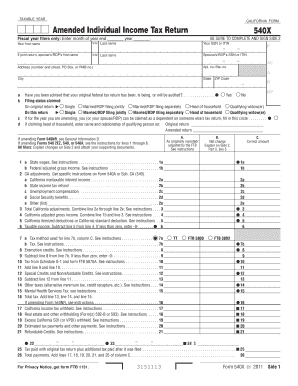

Completing the 2011 Amended 540x Form is an important step for individuals looking to amend their California tax returns. This guide provides clear, step-by-step instructions on how to fill out this form online, ensuring a smooth and efficient process.

Follow the steps to complete your 2011 Amended 540x Form online.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Enter your personal information in the designated fields, including your first name, last name, and SSN or ITIN. If you are filing jointly, include your partner's information.

- Input your address, including street address, city, state, and ZIP code, in the corresponding fields.

- Indicate whether your original federal tax return is being audited by selecting 'Yes' or 'No'.

- Choose your filing status that was claimed on the original return, and then indicate the same for the amended return.

- If applicable, indicate whether you or your spouse/RDP can be claimed as a dependent on someone else's tax return.

- Follow the instructions carefully to report your state wages, federal adjusted gross income, and any California adjustments needed.

- In the 'Explanation of Changes' section on Side 2, detail the changes you are making. Attach any supporting documents as referenced.

- Sign and date the form, ensuring both you and your spouse/RDP sign if filing jointly.

- Finally, save your changes, then download, print, or share your completed form as necessary.

Start filling out your 2011 Amended 540x Form online today for a smoother tax process.

Filling out an amended form involves reviewing your original return and identifying the areas that require correction. Clearly indicate changes in the relevant sections of the amended form and provide reasoning for these adjustments. Using the 2011 Amended 540x Form can facilitate this process, especially with tools available on uslegalforms for added convenience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.