Loading

Get 2015 Met 1 Fillable Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Met 1 Fillable Forms online

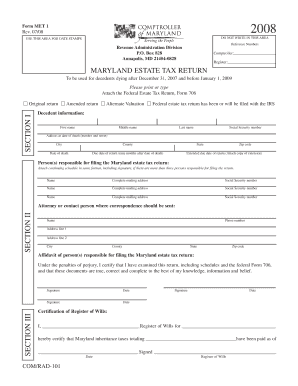

Filling out the 2015 Met 1 Fillable Forms online is an important step for managing Maryland estate tax returns. This guide provides a comprehensive and user-friendly approach to ensure you successfully complete the form.

Follow the steps to effectively complete the 2015 Met 1 Fillable Forms.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate whether the return is an 'original' filing, 'amended' return, or if an alternate valuation is elected by selecting the appropriate boxes in Section I. You will also need to confirm if the federal return, Form 706, has been or will be filed with the Internal Revenue Service.

- Complete all required information about the decedent, including the first name, middle name, last name, social security number, address at the date of death, city, county, date of death, state, and zip code.

- Provide the due date for the return, which is nine months after the date of death, as well as the extended due date if applicable.

- List all persons responsible for filing the Maryland estate tax return. Attach additional schedules if more than three persons are responsible. Make sure to include their names, complete mailing addresses, and social security numbers.

- In Section II, input the attorney or contact person's details for correspondence, including their name, phone number, and complete address.

- In Section III, ensure that all responsible persons sign and date the return, certifying the accuracy of the provided information under penalties of perjury.

- Proceed to Section IV to compute the Maryland estate tax. Follow the outlined instructions for each line, ensuring you input correct values derived from your federal estate tax return, federal Form 706.

- Complete any required additional schedules, such as Schedule A, B, C, and D, if applicable, and attach them to the main form.

- Once all sections are filled out, review the form for inaccuracies. Users can then save changes, download, print, or share the completed form.

Encourage completing the Maryland estate tax return forms online to ensure compliance and accurate submissions.

To mail Maryland Form 505, send it to the address provided on the form itself. Make sure you are using the correct mailing address based on the specifics of your tax situation. For your convenience, you can also download the 2015 Met 1 Fillable Forms to help with your submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.