Loading

Get Form Eq-1 - Keystone Collections Group

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form EQ-1 - Keystone Collections Group online

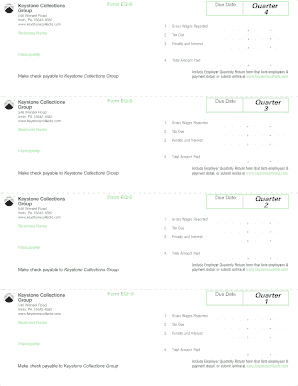

Filling out the Form EQ-1 for the Keystone Collections Group is an essential task for employers with employees residing in the taxing district. This guide will provide you with clear and supportive instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete the Form EQ-1 online.

- Press the 'Get Form' button to access the form and open it in your preferred editor.

- Begin by entering your business name in the designated field. Ensure that it is accurate as this will be used for identification purposes.

- Fill in the due date for your submission. It is critical to submit the form by this date to avoid penalties.

- For each quarter, enter the gross wages reported for all employees. This includes sums before any deductions.

- Next, specify the tax due based on the gross wages reported. This amount will need to be calculated based on applicable rates.

- Include any penalty and interest that may apply if the form or payment is submitted late.

- Calculate and input the total amount paid. Ensure that this reflects all amounts owed, including taxes, penalties, and interest.

- Identify the municipality where your business is located, which is required for tax purposes.

- Review the completed form for accuracy and completeness.

- Finally, save your changes, and you can choose to download, print, or share the finished form.

Complete your Form EQ-1 online today to ensure compliance and timely submissions.

To claim local taxes, you need to gather your tax documents and complete the appropriate forms, notably Form EQ-1 - Keystone Collections Group. If you are eligible for any deductions or credits, ensure you include those in your claim. Consulting with a tax professional or using an online tax platform can also streamline this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.