Loading

Get Form 2248

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2248 online

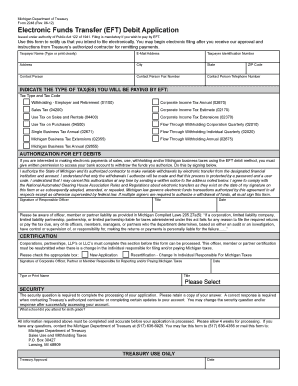

Filling out the Form 2248 online is an essential step for anyone wishing to make electronic payments of taxes in Michigan. This guide provides clear, step-by-step instructions aimed at helping users complete the form accurately and efficiently.

Follow the steps to effectively fill out the Form 2248 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the taxpayer name clearly in the designated field. This identifies the individual or entity responsible for the taxes.

- Provide your email address for communication from the Michigan Department of Treasury regarding your application.

- Enter your taxpayer identification number to link your account and tax records.

- Fill out your address, including city, state, and ZIP code, ensuring all information is accurate.

- Designate a contact person by providing their name, telephone number, and fax number, if applicable. This individual will be responsible for any inquiries regarding the application.

- Indicate the type of tax or taxes you will be paying by EFT by selecting the appropriate options from the listed tax types.

- Authorize EFT debits by signing the authorization section. Make sure to include your title and the date of signing.

- Complete the certification section by selecting whether this is a new application or a recertification, and ensure the responsible officer or partner provides their signature, type or print name, date, and title.

- Answer the security question required for processing your application. Retain a copy of your answer for future reference.

- Review all the information provided for accuracy and completeness before submission.

- Once finished, save the changes, and you can download, print, or share the completed form as needed.

Complete your Form 2248 online today for a smooth electronic tax payment process.

IRS Form 8821 serves as the third-party authorization form. This form allows you to designate someone to receive and inspect your tax information on your behalf. Understanding how to use this form correctly is vital, especially when managing your tax situations with professionals or legal representatives.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.