Get Nys Department Of Taxation And Finance Rp 420 B Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Department Of Taxation And Finance Rp 420 B Form online

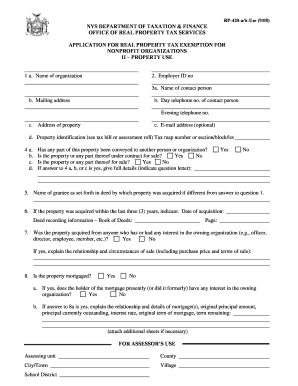

Filling out the Nys Department Of Taxation And Finance Rp 420 B Form online is an essential process for nonprofit organizations seeking property tax exemption. This guide provides clear, step-by-step instructions to help you complete the application accurately and efficiently.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to access the RP 420 B Form and open it in your preferred editor.

- Begin by entering the name of your organization in the designated field (1a). Ensure that this name matches the official registration documents.

- Next, input your Employer ID number (2). This number is crucial for tax identification purposes.

- Fill in the contact person's details (3a-3c), including their name, mailing address, telephone numbers (day and evening), and email address (optional). This information helps assessors reach you.

Ensure you complete your application thoroughly and submit your forms online for property tax exemption.

The certificate of authority granted by the New York State Department of Taxation and Finance allows businesses to collect sales tax in New York. This certification is essential for legal compliance and helps streamline operations. Businesses should complete relevant forms and stay informed about updates regarding the Nys Department Of Taxation And Finance Rp 420 B Form, which may be necessary for maintaining good standing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.