Loading

Get Form 2525

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2525 online

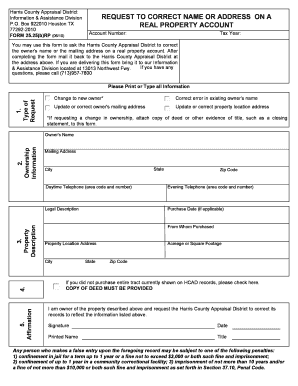

Filling out the Form 2525 is essential for correcting the owner's name or mailing address on a real property account with the Harris County Appraisal District. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Form 2525 correctly

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Select your type of request from the options provided: Change to new owner, Correct error in existing owner's name, Update or correct owner's mailing address, or Update or correct property location address. If you are requesting a change in ownership, remember to attach a copy of the deed or other evidence of title.

- In the ownership information section, enter the owner's name, mailing address, state, city, and zip code. Include the evening telephone number for contact purposes.

- Provide the legal description of the property, along with the daytime telephone number.

- If applicable, enter the purchase date and from whom the property was purchased. Then, specify the property location address, city, state, zip code, and acreage or square footage.

- If you did not purchase the entire tract currently shown on Harris County Appraisal District records, check the box indicating this.

- In the affirmation section, confirm ownership of the property by signing and dating the form. Print your name and title if necessary.

- Once all fields are completed, save your changes. You may then download, print, or share the form as needed before mailing it back to the Harris County Appraisal District at the provided address.

Complete your Form 2525 online today to ensure your property information is accurate.

You can find the DS 157 form on the official U.S. State Department website or through various legal document services. US Legal Forms provides access to Form 2525 and can guide you in obtaining the DS 157 form easily. Utilizing reliable resources can help you meet all your application requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.