Loading

Get Ohio Vp Use Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Vp Use Form online

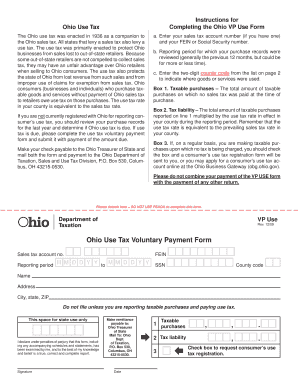

This guide provides clear, step-by-step instructions for filling out the Ohio Vp Use Form online. Whether you are a business or an individual, understanding how to accurately complete this form is crucial for compliance with Ohio's use tax regulations.

Follow the steps to complete the Ohio Vp Use Form with ease.

- Press the ‘Get Form’ button to obtain the Ohio Vp Use Form and open it in your preferred editor.

- Enter your sales tax account number, if applicable, along with your Federal Employer Identification Number (FEIN) or Social Security number.

- Indicate the reporting period by entering the start and end dates (generally covering the previous 12 months) in the MM/DD/YYYY format.

- Select the two-digit county code from the provided list to denote where the goods or services were utilized.

- In Box 1, report the total amount of taxable purchases where no sales tax was paid at the time of purchase.

- Calculate your tax liability by multiplying the amount reported in Box 1 by the applicable use tax rate for your county in Box 2.

- If you regularly make taxable purchases without tax being charged, check the box in Box 3 to request a consumer’s use tax registration form.

- Ensure all information is complete and accurate, then sign and date the form in the designated area.

- Conclude by saving your changes, and choose to download, print, or share the completed form as needed.

Complete your documents online today to ensure your compliance with Ohio tax regulations.

The time it takes for lottery winnings to hit your bank account can vary depending on several factors, including the amount won and the method of claim. Generally, you can expect a waiting period of a few days to several weeks. It's essential to check with the Ohio Lottery for specific timings and requirements, including any necessary submissions via the Ohio Vp Use Form to expedite the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.