Loading

Get 2011 Schedule Se

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Schedule SE online

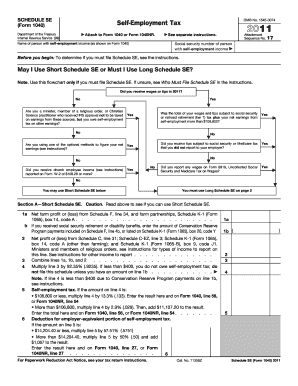

Filling out the 2011 Schedule SE form is an essential step for anyone with self-employment income. This guide provides clear, step-by-step instructions to help you accurately complete the form and understand its components.

Follow the steps to successfully complete Schedule SE.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the person with self-employment income as it appears on Form 1040 in the designated field.

- Provide the social security number of the individual with self-employment income in the appropriate section.

- Determine if you need to file Schedule SE by consulting the provided instructions. Complete the flowchart to identify whether to use Short Schedule SE or Long Schedule SE based on your earnings.

- If using the Short Schedule SE, start with Section A. Enter your net farm profit or loss from Schedule F, line 34, in line 1a.

- If applicable, include any social security retirement or disability benefits related to Conservation Reserve Program payments in line 1b.

- Report your net profit or loss from other sources on line 2, ensuring you adhere to the guidance for specific income types for ministers or members of religious orders.

- Combine lines 1a, 1b, and 2, then calculate your adjusted amount on line 4 by multiplying the total by 92.35%.

- Calculate your self-employment tax on line 5 based on the amount derived from line 4 and input it accordingly.

- If completing Long Schedule SE, fill out Part I starting with the net farm profit or loss and additional parameters as per the instructions provided.

- After completing all relevant fields, make sure to save your completed document. You can choose to download, print, or share the form as needed.

Start filling out your Schedule SE online today for a smooth filing experience.

Related links form

Individuals who are self-employed must fill out the 2011 Schedule SE. This includes freelancers, independent contractors, and business owners reporting their income. Completing this schedule helps you calculate the self-employment tax owed on your earnings. If you need more assistance in preparing Schedule SE, US Legal Forms can provide valuable resources and templates to guide you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.