Loading

Get Ohio Sd 101 Short Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Sd 101 Short Form online

Filling out the Ohio Sd 101 Short Form can seem daunting, but with the right guidance, you can complete it successfully online. This guide provides clear and supportive instructions on how to navigate each section of the form with ease.

Follow the steps to fill out the Ohio Sd 101 Short Form online effectively.

- Press the ‘Get Form’ button to access the Ohio Sd 101 Short Form and open it in your preferred online editor.

- Begin by entering your Ohio withholding account number in the designated field at the top of the form.

- Provide the Federal Employer Identification Number (FEIN) in the next section as requested.

- Input the period ending date for which you are filing this form using the specified date format (MM/DD/YYYY).

- Fill in your name and address details, including the number and street, city, state, and ZIP code.

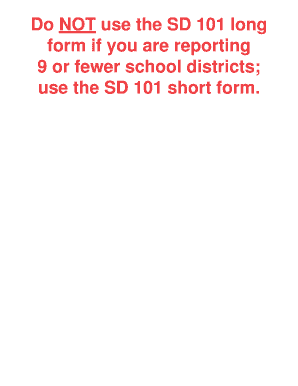

- Select the appropriate school district for your submission from the provided list, identifying its name and number.

- Calculate and enter the total district tax due based on your earnings and withholding for the respective period.

- Complete the declaration statement by signing and dating the form at the bottom to affirm that the information provided is accurate.

- After filling out all required sections, make sure to save your changes, then choose to download, print, or share the completed form as needed.

Start filling out your Ohio Sd 101 Short Form online today!

Yes, you can file your Ohio school district taxes online. Using the Ohio SD 101 Short Form simplifies this process, making it convenient and efficient. Many digital platforms, including US Legal Forms, offer user-friendly tools that guide you through filing your taxes correctly. You can complete and submit your forms from the comfort of your home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.