Get Residential Homestead Exemption 2012 Travis Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Residential Homestead Exemption 2012 Travis Form online

This guide provides clear and supportive instructions for completing the Residential Homestead Exemption 2012 Travis Form online. By following these steps, you will be able to efficiently navigate the process and ensure that your application is accurately submitted.

Follow the steps to complete your application online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

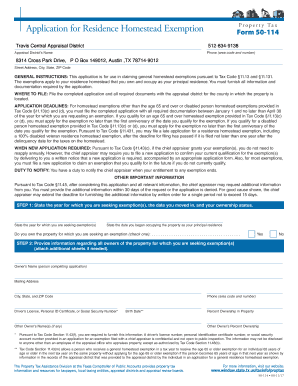

- In this step, indicate the year for which you are seeking exemption(s), the date you moved into the property, and confirm your ownership status by checking 'Yes' or 'No'.

- Provide detailed information regarding all owners of the property, including their names, mailing addresses, phone numbers, driver’s license numbers or social security numbers, birth dates, and percent ownership in the property.

- Describe the property for which you are seeking exemption(s), including the street address, legal description, appraisal district account number, and number of acres used for residential purposes, not exceeding 20. If applicable, include the make, model, and identification number of a manufactured home.

- Identify the exemptions that apply to you by checking the appropriate boxes and providing the name and date of death of the deceased spouse if claiming the surviving spouse exemption.

- Attach all required documents, such as a copy of your driver’s license or state-issued ID, vehicle registration receipt, and any affidavits needed for manufactured homes or non-ownership of vehicles.

- If you are a resident of cooperative housing, confirm your exclusive right to occupy the unit by checking 'Yes' or 'No'.

- Read the application carefully, sign, and date it, affirming that all information provided is true and correct. Verify your understanding of penalties for false statements.

- Once all sections are complete, save your changes, download the application, print it, or share it as necessary.

Start filling out your Residential Homestead Exemption form online today.

If you forgot to file your homestead exemption in Texas, you may face increased property taxes. However, you might still have the opportunity to apply for a late exemption, depending on your circumstances. Review the policies outlined for the Residential Homestead Exemption 2012 Travis Form to see if you qualify for any late applications. Contact your local appraisal district for further guidance on your options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.