Loading

Get Cook County Department Of Revenue Tax Compliance Unit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cook County Department Of Revenue Tax Compliance Unit Form online

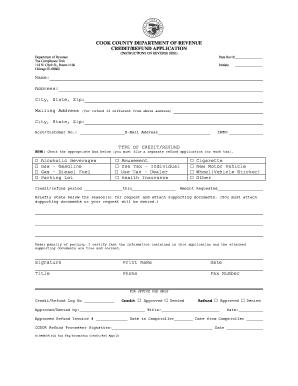

This guide provides clear instructions on how to fill out the Cook County Department Of Revenue Tax Compliance Unit Form for tax credit and refund applications. Follow the outlined steps to ensure your submission is completed accurately and efficiently.

Follow the steps to complete your tax compliance form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Fill in the date received section with the current date and leave the initials space blank for official use.

- Input your name, address, city, state, and zip code in the respective fields.

- If your mailing address differs from your residential address, provide that information in the mailing address section along with the corresponding city, state, and zip code.

- Enter your account or customer number in the designated field.

- Provide your email address in the appropriate field to ensure communication regarding your application.

- Fill in your Illinois Business Tax Number (IBTN) in the next field.

- Select the type of credit or refund by checking the appropriate box that corresponds to your claim.

- Indicate the credit/refund period by providing the relevant time frame in the designated section.

- Specify the amount you are requesting as a credit or refund in the corresponding field.

- Briefly explain the reason for your request in the provided space and make sure to attach all necessary supporting documents, as they are required for processing.

- Sign and print your name in the designated fields, along with the date of submission.

- Include your title, phone number, and fax number if applicable in the respective fields.

- Review your form to ensure all information is complete and accurate.

- Once confirmed, you can save changes, download, print, or share the completed form as needed.

Complete your Cook County tax compliance documents online today for a smooth filing experience.

In Cook County, there is no specific age at which you automatically stop paying property taxes. However, senior citizens may be eligible for exemptions that can significantly reduce their property tax burden. Utilizing the Cook County Department Of Revenue Tax Compliance Unit Form can help you apply for these exemptions and ensure you receive the benefits you deserve.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.