Get Mo Dor Form 4924

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Dor Form 4924 online

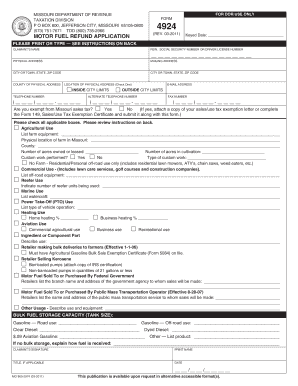

Filling out the Mo Dor Form 4924, the Motor Fuel Refund Application, can be straightforward if you follow the right steps. This guide provides clear and concise instructions and covers each section of the form to help you complete it accurately.

Follow the steps to successfully fill out the form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the claimant’s name and physical address, including the city, state, and zip code. Ensure that you provide a street address and, if different, a mailing address.

- List your Federal Identification Number (FEIN), Social Security Number, or Driver License Number in the designated field.

- Specify the county of your physical address.

- Indicate whether your physical address is inside or outside city limits by circling the appropriate option.

- Provide your email address, telephone number, alternate phone number, and fax number in the respective fields.

- Determine if you are exempt from Missouri sales tax by checking 'Yes' or 'No.' If yes, attach a copy of your exemption letter or complete Form 149.

- For agricultural use, list your farm equipment, the physical location and county of the farm, the number of acres owned or leased, and the number of acres in cultivation. If applicable, indicate if you perform custom work.

- In the commercial use section, list the number and type of commercial off-road equipment you use.

- If applicable, fill in the sections for reefer use, marine use, power take-off (PTO) use, heating use, aviation use, and any other usage with detailed descriptions.

- Indicate your bulk fuel storage capacity and explain how fuel is received if you do not have bulk storage.

- Sign and date the form, print your name, and provide your title if applicable.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete your Mo Dor Form 4924 online today to ensure a smooth refund process.

The Missouri gas tax rebate amount is typically determined by the number of gallons of gas you purchased and the prevailing gas tax rate during that period. It’s essential to calculate this carefully to ensure you are claiming the correct rebate amount on Mo Dor Form 4924. Additionally, changes in legislation might affect this rebate, so staying updated through the Missouri Department of Revenue is a good practice. Make sure you stay informed to capitalize on your eligibility.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.