Loading

Get 804 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 804 Form online

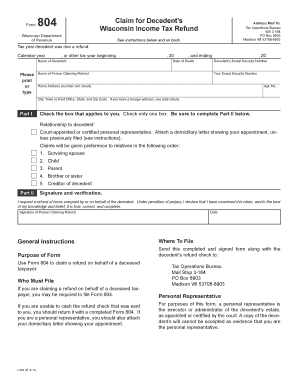

Filling out the 804 Form online can help you efficiently claim a Wisconsin income tax refund on behalf of a deceased taxpayer. This guide provides clear, step-by-step instructions designed to support users through the entire process.

Follow the steps to complete the 804 Form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering the tax year for which the decedent was due a refund. This includes specifying whether it is a calendar year or another tax year.

- Fill in the name of the decedent clearly. Make sure to enter the name as it appears on official documents.

- Input the decedent’s date of death accurately. This is important for processing the claim.

- Enter the name of the person claiming the refund. This should be the individual making the request on behalf of the decedent.

- Provide the decedent’s Social Security Number and your own Social Security Number in the designated fields.

- Complete the home address section, ensuring all details such as street number, apartment number (if applicable), city, state, and zip code are correct. For foreign addresses, follow the specific entry order as instructed on the form.

- In Part I, check the box that pertains to your relationship with the decedent. Only select one box and ensure that you provide the necessary documentation if required.

- Proceed to Part II to sign and verify your claim. Here, you will declare that you have examined the claim and affirm its accuracy. Don't forget to include the date and your signature.

- Once you have reviewed all entries for accuracy, you can save your changes, download a copy of the form, or print it directly from the online editor.

Complete your documents online to ensure a smooth filing process.

Filing an income tax return for an LLP requires completing the ITR-5 form and submitting it electronically or manually, depending on your preference. Ensure you include all relevant income and deductions to avoid issues later. UsLegalForms is an ideal resource for assistance on finding the right forms, including the 804 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.