Get Automated Loan Examination Review Tool Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Automated Loan Examination Review Tool Form online

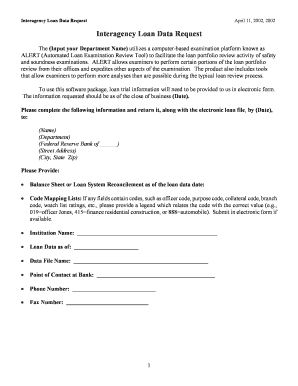

Completing the Automated Loan Examination Review Tool Form is essential for accurate loan portfolio reviews. This guide provides clear, step-by-step instructions tailored to assist users in filling out the form effectively online.

Follow the steps to fill out the form easily and accurately.

- Click the ‘Get Form’ button to access the Automated Loan Examination Review Tool Form and open it in your preferred editing tool.

- Begin by filling out the institutional details, including the institution name, loan data date, and the responsible point of contact. Ensure that all required fields are completed as accurately as possible.

- Provide the balance sheet or loan system reconciliations as of the specified loan data date. This section is crucial for an accurate assessment of your institution's loan portfolio.

- Prepare and submit code mapping lists for any fields that contain specific codes (e.g., officer code, purpose code). This legend enables examiners to interpret the data correctly.

- For the loan data itself, ensure all required loan details are entered according to the specified formats. Pay careful attention to character limits and the appropriate data types (e.g., numeric, alphanumeric, date).

- Review the loan detail rows, confirming that all loans with outstanding balances are included. Remove any loans that are paid off or otherwise closed from this section.

- Final checks: verify that each section is complete, all data is accurate to your records, and ensure no fields are left blank unless instructions specify otherwise.

- Once everything is filled out and verified, save your changes, then download, print, or share the form as required by your institution.

Start completing your Automated Loan Examination Review Tool Form online now for a streamlined loan review process.

RM, or Risk Management, plays a pivotal role in identifying and mitigating potential losses in banking operations. This involves evaluating various financial risks and implementing strategies to safeguard the institution's assets. By employing the Automated Loan Examination Review Tool Form, banks can enhance their risk management processes, ensuring they comply with financial regulations and protect their customers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.