Loading

Get Ga Dor Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ga Dor Forms online

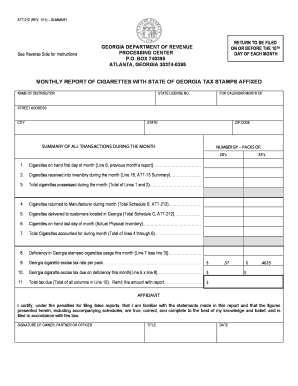

Filling out the Ga Dor Forms online can streamline the reporting process for distributors. This guide provides clear, step-by-step instructions to assist users in completing the Monthly Report of Cigarettes with State of Georgia Tax Stamps Affixed accurately.

Follow the steps to complete the Ga Dor Forms online efficiently.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling in the distributor's name and state license number at the top of the form. Ensure all details are accurate as they are critical for identification.

- Input the calendar month for which the report is being filed. This date helps to contextualize the data reported.

- Enter the street address, city, state, and ZIP code for the place of business, as these identify where the transactions occurred.

- In the summary section, start with line 1 by entering the number of packs of cigarettes on hand at the first day of the month.

- Continue to line 2 and report the number of packs received into inventory during the month. Calculation conversion from tax stamps should be applied as instructed.

- For line 3, sum the numbers from lines 1 and 2 to get the total cigarettes possessed during the month.

- In line 4, input the total number of packs returned to the manufacturer and make sure to include documentation if required.

- On line 5, record the total number of packs that were delivered to customers in Georgia.

- For line 6, provide the number of packs in hand at the last day of the month, ensuring this is based on a physical inventory count.

- Calculate the total cigarettes accounted for in line 7 by adding the figures from lines 4 through 6.

- Line 8 should reflect any deficiency in Georgia-stamped cigarette usage by subtracting line 3 from line 7; if line 3 is greater than line 7, leave this line blank.

- Line 9 is pre-filled with the Georgia cigarette excise tax rate per pack, based on the pack size.

- Compute the tax due on line 10 by multiplying the deficiency from line 8 by the tax rate on line 9.

- Finally, on line 11, total all tax amounts calculated and prepare to submit this amount with the report.

- Complete the affidavit section by certifying the accuracy of the information provided. Sign and date the form before submission.

- Once all entries are complete, save the form, download it, or print it as necessary. Ensure to mail it along with any required remittance by the 10th day of the next month.

Take the next step and complete your Ga Dor Forms online today.

Yes, some post offices provide a selection of tax forms, including the 1040. However, availability may vary by location, so it's a good idea to call ahead. If your local post office doesn't have what you need, consider visiting Ga Dor Forms for a comprehensive selection of state and federal tax forms that you can download and print.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.